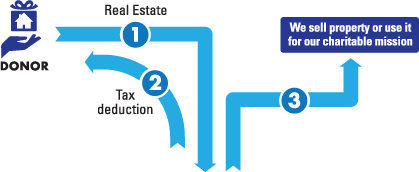

Gifts of Real Estate

How It Works

- You deed your home, vacation home, undeveloped property, or commercial building to Acts Legacy Foundation, Inc.

- Acts Legacy Foundation, Inc. may use the property or sell it and use the proceeds.

Benefits

- You receive an income tax deduction for the fair market value of the real estate.

- You pay no capital gains tax on the transfer.

- You can direct the proceeds from your gift to a specific program at Acts Legacy Foundation, Inc.

Next

- Frequently asked questions on gifts of real estate.

- Contact us so we can assist you through every step.